Reduced demand shows in sales but is not reflected in prices

New homes have experienced the same record price appreciation that the overall market has seen in the past two years. In June, the annual appreciation for new home prices was 17%, which is only slightly below 20% for existing homes1. To develop a more complete picture of the overall market, we must also look at the number of sales — and those tell a different tale.

Figure 1: New and Existing Home Price Appreciation, Jan 2012-Jun 2022

Nationally, new home sales have been down over 13% in every month of 2022. To put this in perspective, in May 2020, at the height of the shutdowns, the decline was only 10%. The current decline is likely due to the reduced demand for homes caused by interest rate increases2.

Home sales follow a volume cycle rather than a price cycle, and this phenomenon is exaggerated for new homes. When demand dries up, developers prefer to delay projects and wait out the downturn. Homes that developers do sell during these periods are the ones for which they can still command a high price. Since few people are willing to pay the same price with higher interest rates, prices remain the same and sales go down.

Figure 2: New and Existing Home Sales, Jan 2012-Jun 2022

The top markets for new home sales are primarily located in the South, with Dallas and Houston leading the way. Out of the top 10 markets, the only geographic outlier is New York City since it constructs more new condos than other markets. However, if we consider only single-family homes, this market would fall toward the bottom of the ranking for new home sales.

Figure 3: New Home Sales Top 10, June 2021-May 2022

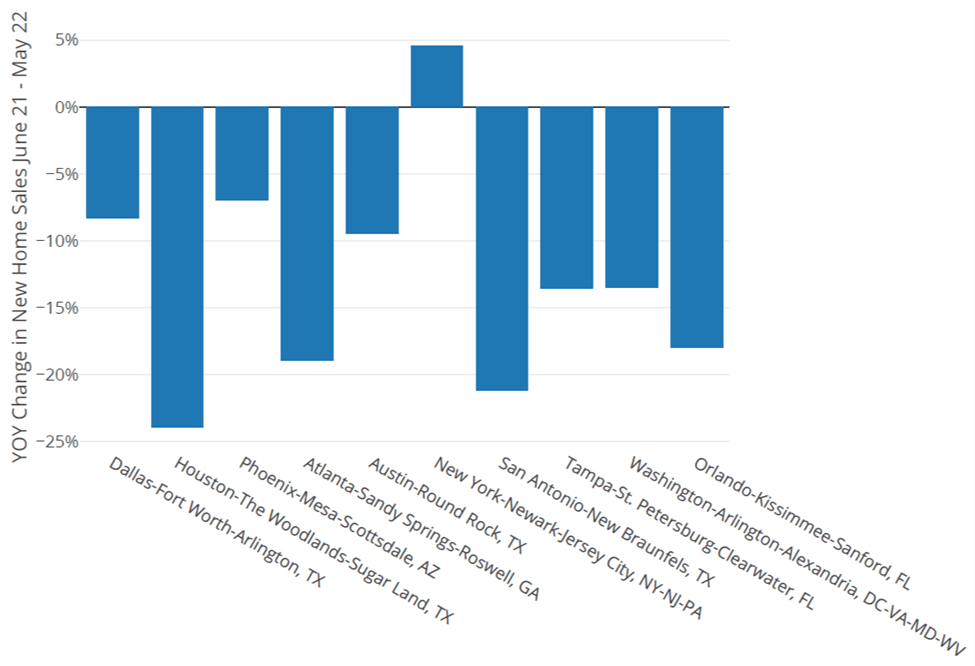

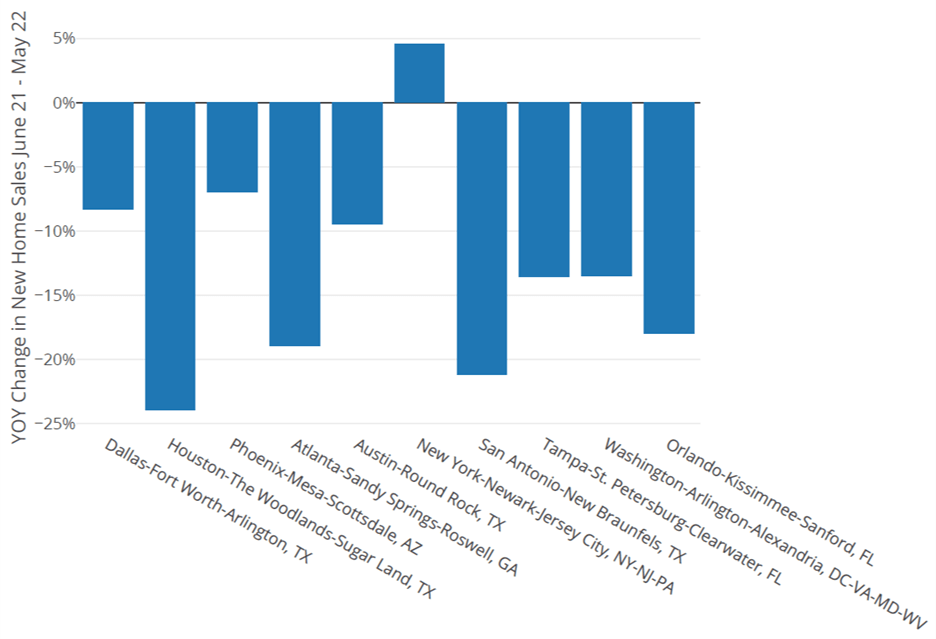

This drop in sales is widespread. The number of new home sales is down in nine of the top 10 markets, with declines ranging from just under 10% in Phoenix to over 20% in Houston. Again, the exception is New York, but this is due to a bounce-back effect from the recent pandemic-induced weakness in the city’s condo market.

Figure 4: Year-Over-Year Growth in New Home Sales, June 2021-May 2022

Overall, the conditions seem set for new home sales volumes to remain subdued. As a result, while price drops are indeed possible, precedent suggests that prices will simply stall while developers wait for demand to catch up. Now that the recent record price increases are no longer offset by low mortgage rates, this may take some time.

[1] Existing home price appreciation uses the CoreLogic HPI https://www.corelogic.com/intelligence/u-s-home-price-insights/. New home appreciation is author’s own calculation using a hedonic methodology detailed in https://www.corelogic.com/intelligence/which-increased-more-new-or-existing-home-prices/.